Determine if the employee's gross annual wages are less than or equal to the amount shown in the Low Income Exemption Table below. election, UC automatically withholds California tax from your monthly payments based on the tax table for a married individual claiming three allowances.As your combined income increases, so do your tax rates. TY 2022 - 2023 What is the Married Filing Jointly Income Tax Filing Type Married Filing Jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns. Withholding Formula >26 < to obtain the gross annual wages. Married couples filing jointly or qualifying widows also have tax brackets ranging from 1 to 12.3. If the employee is using a W-4 in lieu of the California state DE-4, the information for the Additional Exemptions Claimed field should be notated on the W-4.

Ca tax brackets married filing jointly plus#

If no exemptions are claimed, enter 00.ĭetermine the Additional Exemptions Claimed field as follows:įirst and Second Positions - Enter the number of allowances claimed in Item 2 of the DE-4. That’s the 2023 regular standard deduction of 27,700 for married taxpayers filing joint returns, plus three additional standard deductions at 1,500 apiece. Second and Third Positions - Enter the total number of regular allowances claimed in Item 1 of the DE-4.

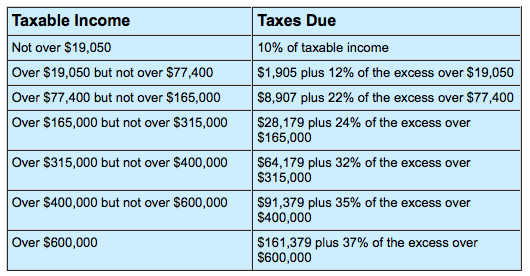

Enter M (married), S (single), or H (head of household). 22 for taxable income over 39,475 (78,950 for married couples filing jointly) 24 for taxable income over 84,200 (168,400 for married couples filing. S, M, H / Number of Regular Allowances / Number of Allowancesĭetermine the Total Number Of Allowances Claimed field as follows:įirst Position - Enter the employee's marital status indicated on the allowance certificate.

0 kommentar(er)

0 kommentar(er)